Best Apps to Track Expenses & Savings in UAE (2025 Guide)

In today’s fast-paced and digitally connected UAE lifestyle, managing personal finances is more than just saving receipts or checking your bank balance at the end of the month. That’s where mobile financial tools come into play, helping users not only track spending but also plan for the future, set budgets, and receive smart financial insights all in one place.

The UAE has seen a sharp rise in the adoption of personal finance apps, with more users leaning on digital platforms for everything from tracking coffee runs to setting investment goals. Whether you’re trying to control daily expenses, save for your dream home, or simply build healthier money habits, the following finance apps are trusted by thousands in the Emirates and might just be the perfect financial companion you’ve been looking for.

1. YAP – UAE’s First Digital Bank With Built-in Budgeting

Optimized For: Local UAE residents who want full digital banking + finance tools

Pricing: Free

Key Features:

- Automatic import of transactions from UAE bank accounts

- Real-time budget analysis and spending categorization

- Built-in savings modules offering competitive interest rates

- Bill payment integrations and spend alerts

User Feedback: Seamless local banking integration makes YAP a comprehensive tool for budgeting, saving, and paying all within a UAE-centric platform.

2. Wally – Visual, Multi-Currency Impressions

Optimized For: Expats and frequent travelers needing AED + USD/EUR tracking

Pricing: Free (premium features optional)

Key Features:

- Syncs with UAE & global banks

- Multi-currency support and receipt photo storage

- Smart insights on spending habits

- Geotagging and workload tracking

User Feedback: Aesthetic, intuitive interface with strong insights and location tagging ideal for tracking lifestyle expenses across currencies.

3. Spendee – Group-Friendly, Visual Budgeting

Optimized For: Families, roommates, travel groups

Pricing: Free basic; Premium unlocks shared wallets etc.

Key Features:

- Color-coded visuals and trend charts

- Shared wallets for group expense transparencies

- Auto-categorization with UAE support

- Multi-currency tracking

User Feedback: Collaborative budgeting makes it popular for shared household costs significant for families and flatmates in the UAE.

4. Sav – Homegrown UAE Budgeting & Investing

Optimized For: UAE residents wanting local expertise and financial goal tracking

Pricing: Free, with premium tiers for investing

Key Features:

- Category-specific budgeting and savings goal setting

- Personalized UAE-based investment insights

- Local expert-led financial advice

User Feedback: Built specifically for the UAE supports AED budgeting, savings milestones, and curated investment tracking.

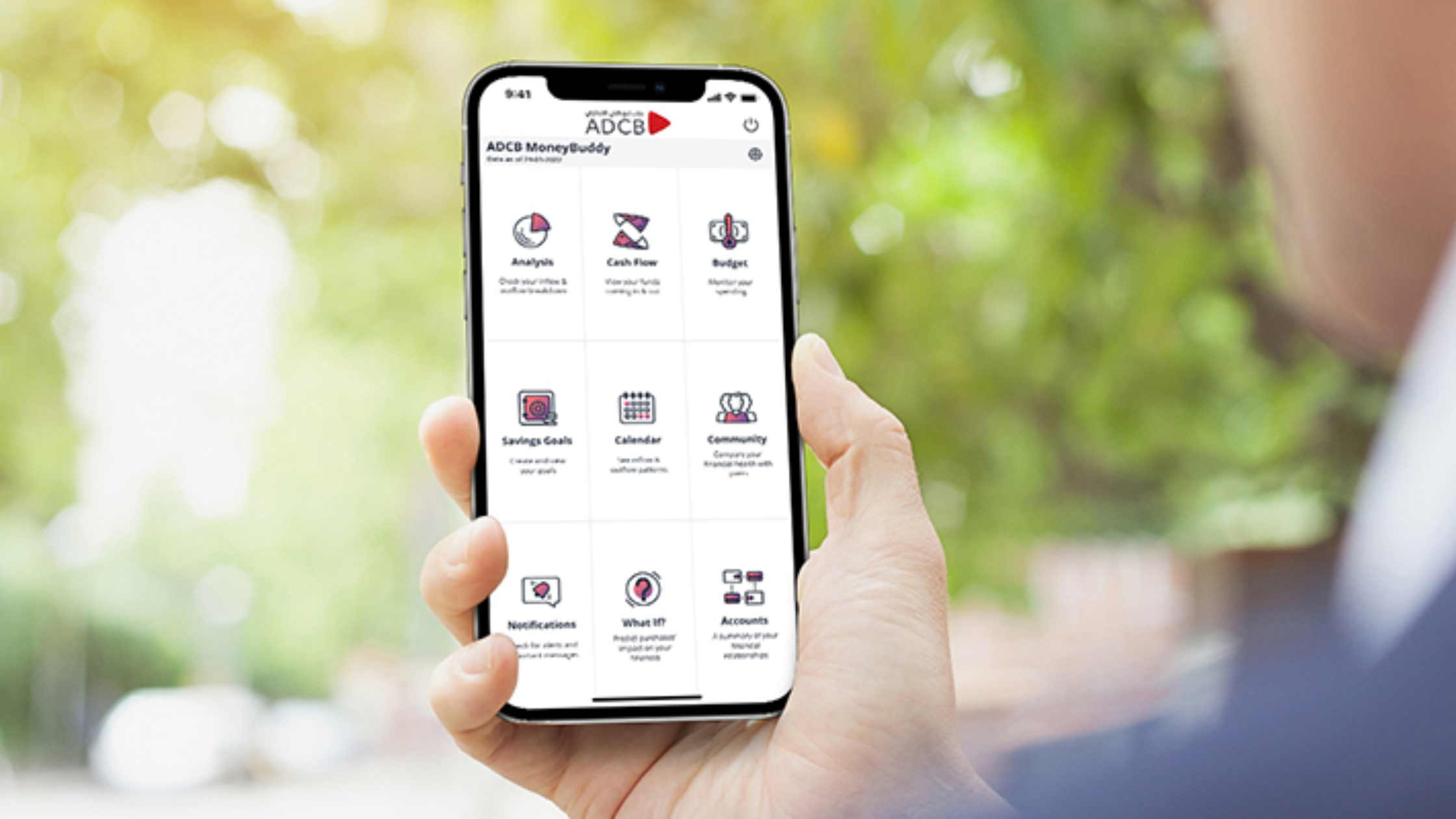

5. ADCB MoneyBuddy – Embedded in UAE Banking

Optimized For: Abu Dhabi Commercial Bank account holders

Pricing: Free (for ADCB users)

Key Features:

- Bank statement-based spending breakdown

- Bill payments and category-wise budget control

- Insights with savings recommendations

User Feedback: Directly built into ADCB’s ecosystem MoneyBuddy makes tracking money seamless and integrated for UAE residents.

6. Fudget – Extreme Simplicity for Budget Beginners

Optimized For: Users who want manual, no-chart budgeting

Pricing: Free

Key Features:

- Simple income/expense lists; no charts or categories

- Personalized budgets per period (daily, weekly)

- Supports AED currency

User Feedback: Ideal for minimalists who just want to log spending without complicated features or visuals especially helpful for personal journaling-style finance.

Choose the Right App for Your Money Goals

Each of these six apps brings something unique to the table—whether it’s simplicity, smart insights, or seamless integration with UAE banks. Think about what suits your lifestyle best: are you a frequent traveler, a minimalist, or someone who needs shared budgeting? Test a couple of them and find the one that makes your financial journey smoother and stress-free.