Blackstone to Invest $500 Billion in Europe Over 10 Years

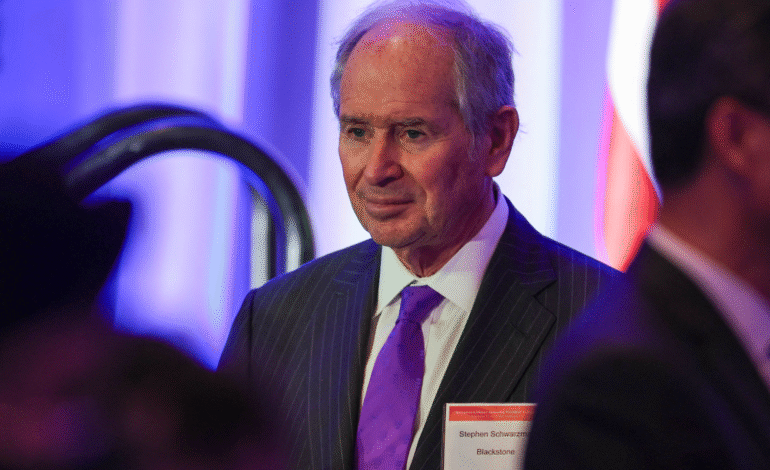

In a significant financial development, Blackstone, one of the world’s largest investment firms, has unveiled plans to dramatically increase its presence in Europe. CEO and co-founder Stephen Schwarzman announced on Tuesday that the firm intends to invest at least $500 billion across the continent over the next ten years. This ambitious strategy represents a major shift in Blackstone’s global investment outlook and reflects growing confidence in Europe’s economic potential.

Speaking to the Financial Times, Schwarzman revealed that Blackstone already has approximately $350 billion invested in European assets. The proposed expansion aims to capitalize on emerging opportunities in the region and respond to shifting economic conditions. “We are seeing signs of change,” Schwarzman stated, suggesting Europe could be on the cusp of renewed economic momentum.

Renewed Economic Optimism in Europe

Schwarzman attributed Blackstone’s bold strategy to a changing mindset among European policymakers. Over the past decade, the continent has experienced sluggish economic growth, but there is increasing recognition among leaders that such trends are unsustainable. As a result, there are signs of movement toward regulatory reform.

“European leaders are generally becoming more sensitive to the fact that their growth rates over the past decade have been quite low and it’s not sustainable for them,” Schwarzman said. “So they are looking at putting pressure on the European Union regarding deregulation.”

According to him, this shift toward deregulation and structural change offers a pathway for stronger economic performance. Blackstone believes that if these reforms materialize, Europe may outperform its previous economic track record.

Economic Fundamentals Attract Investment

Blackstone’s optimism isn’t driven solely by regulatory expectations. Underlying economic fundamentals also play a critical role. The firm points to significantly lower company valuations in Europe compared to U.S. counterparts as a key investment incentive. For private equity firms like Blackstone, this creates opportunities to acquire strong companies at relatively lower prices.

Financing conditions in Europe are also more favorable. With lower interest rates and more accessible capital, the region offers an attractive environment for large-scale investment. In an interview with Bloomberg Television, Schwarzman described Europe as “a major opportunity,” citing the convergence of lower valuations, cheaper financing, and policy change.

Market Sentiment Aligns With Investment Plans

Investor sentiment across European markets appears to align with Blackstone’s outlook. The Stoxx Europe 600 index has climbed 9% so far this year, while Germany’s DAX index has surged 20%, reflecting optimism about future growth. Analysts credit renewed government spending and broader economic optimism for the positive market trends.

Germany, Europe’s largest economy, recently unveiled significant infrastructure investment plans following years of tight fiscal policy. This pivot could catalyze growth and stimulate private sector participation. Defense spending is also increasing in several European countries in response to evolving global security priorities. These changes further support Blackstone’s confidence in Europe’s economic prospects.

A Stark Contrast to Davos Skepticism

Blackstone’s forward-looking approach stands in contrast to sentiments expressed earlier this year at the World Economic Forum in Davos. At that event, many participants voiced concerns about Europe’s economic direction, emphasizing overregulation, market fragmentation, and risk aversion.

Larry Fink, CEO of BlackRock, commented, “I don’t see Europe moving forward enough; I see Europe still focusing on backward looking too much.” This skepticism was matched by enthusiasm for the U.S., where participants anticipated a more business-friendly environment in the event of a second term for then-President Donald Trump.

However, as global dynamics evolved, the U.S. faced its own challenges. Trump’s trade war policies introduced considerable uncertainty into the economic outlook. U.S. financial markets experienced significant turbulence, with a steep decline following “Liberation Day,” though those losses were later recovered.

Global Shifts Influence Investment Trends

The market volatility in the U.S. contributed to a broader shift in global investment strategies. Analysts have referred to a “Sell America” trend, which saw investors reducing exposure to U.S. assets, including the dollar. These developments have led firms like Blackstone to explore more promising opportunities outside the U.S.

In this context, Europe’s improving macroeconomic indicators and political will for reform present a compelling alternative. Blackstone’s decision to allocate $500 billion over the next decade aligns with a broader strategy of global diversification amid changing economic conditions.

A Long-Term Vision Anchored in Reform and Growth

The scale and timeframe of Blackstone’s commitment suggest a carefully considered, long-term strategy. Rather than focusing on short-term returns, the firm appears to be building a sustainable investment portfolio across multiple sectors and markets in Europe.

Key areas likely to benefit from this capital injection include private equity, real estate, infrastructure, and credit. Infrastructure, in particular, is expected to be a major focus, as many European countries prioritize modernization and green development. These investments could play a crucial role in boosting Europe’s competitiveness and economic resilience.

By spreading investments across a variety of asset classes and countries, Blackstone can manage risk while capitalizing on localized growth. This diversified approach positions the firm to respond flexibly to ongoing changes in the global financial landscape.

Blackstone’s Strategic Bet on Europe’s Future

Blackstone’s $500 billion investment plan signals a pivotal moment in global finance. As economic power centers shift and new opportunities emerge, the firm is making a decisive bet on Europe’s long-term potential.

Whether this ambitious strategy yields the expected returns will depend on a mix of regulatory outcomes, political developments, and global economic trends. Nonetheless, the move underscores a growing recognition that Europe may be poised for a period of renewal and expansion.

By leading the way, Blackstone could set a precedent for other global investors, reinforcing Europe’s role as a major destination for strategic capital in the years to come.