Dubai Property Transactions Soar to AED17.99 Billion in One Week

Dubai’s real estate sector has once again demonstrated its resilience and attractiveness with a remarkable AED17.99 billion worth of property transactions recorded over a single week. This data, released by the Dubai Land Department (DLD), highlights the emirate’s dynamic property market, which continues to draw the attention of both local and international investors. The volume and value of these deals are not just a reflection of strong investor sentiment, but also underline the evolving nature of the emirate’s property landscape, supported by regulatory advancements, diversified real estate offerings, and a globally appealing lifestyle. Dubai’s property sector, bolstered by an investor-friendly environment and futuristic infrastructure, remains one of the most active and lucrative markets in the world.

Record-Breaking Figures Reflect Investor Confidence

The AED17.99 billion in property transactions marks a substantial figure, indicating robust demand across all property categories, from residential and commercial units to land plots and off-plan sales. This consistent momentum suggests that Dubai’s real estate market is maturing into a stable yet highly active domain that offers diverse investment opportunities. Investors from different parts of the globe continue to pour capital into Dubai’s market, attracted by its high returns, tax advantages, and long-term growth potential.

The transactions span a variety of neighborhoods and developments, each showcasing unique value propositions. Whether it’s luxury waterfront villas, centrally located apartments, or expansive land plots for future development, Dubai continues to cater to a wide spectrum of investor profiles.

Residential Segment Continues to Dominate

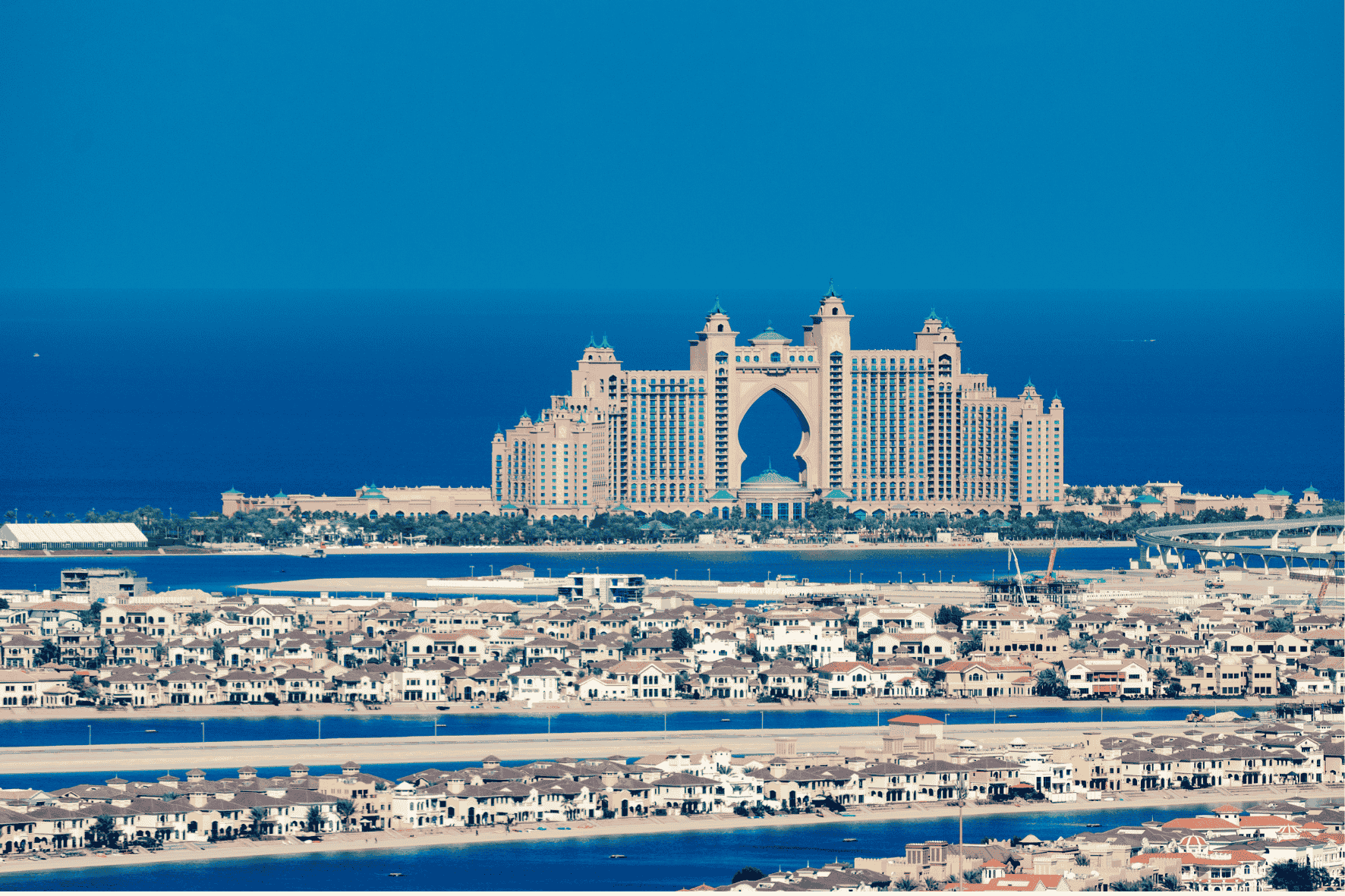

A significant portion of last week’s transactions came from the residential segment, highlighting the strong demand for homes in Dubai. Buyers are particularly drawn to areas that combine luxury with convenience, such as Dubai Marina, Downtown Dubai, Business Bay, and Palm Jumeirah. These prime locations consistently remain high on the radar for both end-users and investors due to their proximity to business hubs, entertainment venues, and world-class amenities.

The surge in demand for villas and townhouses is also noteworthy, driven by post-pandemic preferences for larger living spaces and private outdoor areas. Master communities like Arabian Ranches, Dubai Hills Estate, and Damac Hills have seen a continuous uptick in transaction volumes. This trend is complemented by Dubai’s family-friendly infrastructure, international schools, green spaces, and easy access to commercial districts.

Off-Plan Market Sees Continued Surge

Dubai’s off-plan property market also contributed significantly to the week’s transaction volume. This sub-sector has witnessed remarkable growth over the past year, as investors look to capitalize on lower entry prices and flexible payment plans offered by developers. Off-plan developments in new and upcoming communities such as Dubai South, Jumeirah Village Circle, and Mohammed Bin Rashid City have drawn substantial interest.

Developers continue to launch new projects backed by innovative designs, modern features, and high potential for capital appreciation. The regulatory framework ensuring transparency and protection for off-plan buyers has further strengthened confidence in this segment. The influx of overseas investors seeking secondary residences or long-term assets in Dubai is playing a major role in boosting off-plan sales.

Land Transactions Showcase Development Potential

Beyond residential units, land transactions have emerged as another major contributor to the AED17.99 billion figure. Large land deals, particularly in areas earmarked for future urban expansion and infrastructure growth, signal the intent of institutional investors and developers to continue building in Dubai. Such transactions highlight the long-term vision of stakeholders who recognize the potential for new communities, mixed-use developments, and commercial zones in the city’s evolving skyline.

Strategic areas like Dubai Investment Park, Meydan, and Al Barsha have witnessed increased interest for land purchases. This bodes well for the city’s plans to support population growth and economic diversification through real estate-driven development.

Commercial and Retail Spaces Gain Momentum

While residential and land assets took center stage, the commercial and retail real estate sectors also contributed notably to the weekly transaction volume. With Dubai’s economy recovering strongly post-pandemic, the demand for office spaces, retail outlets, and warehouse facilities has seen a consistent rise. Businesses are expanding their footprints, and new startups are entering the emirate, all of which require commercial real estate.

Districts like Business Bay, Dubai Internet City, and Jumeirah Lake Towers are witnessing renewed interest from commercial tenants and investors alike. Flexible office concepts, co-working spaces, and retail units in mixed-use developments are particularly attractive, especially for entrepreneurs and SMEs.

Foreign Investment Remains a Key Driver

A critical component of Dubai’s property success story lies in its ability to attract foreign investment. The emirate’s strategic location, quality of life, and business-friendly policies have made it a preferred choice for international investors. Recent changes to residency laws, including the introduction of the Golden Visa and long-term investor visas, have only accelerated this trend.

Investors from countries like India, China, Russia, the UK, and GCC nations are actively participating in Dubai’s real estate market. Their sustained interest is evident in the diversity of properties being transacted — from compact apartments for rental yield to high-end luxury villas for personal use or asset diversification.

Government Policies Supporting Growth

The Dubai Land Department, along with other government bodies, has played a pivotal role in creating a transparent, secure, and well-regulated real estate ecosystem. From digital platforms for property registration to escrow regulations and broker certifications, the city has embraced a progressive approach to property governance.

These initiatives have not only enhanced investor confidence but also contributed to the efficiency and speed of property transactions. The seamless integration of technology in real estate processes is a testament to Dubai’s commitment to fostering a globally competitive property market.

Sustainability and Smart Living Impacting Buyer Preferences

Another factor influencing property choices in Dubai is the increasing emphasis on sustainability and smart living. Developers are integrating green building practices, energy-efficient solutions, and digital infrastructure into their new projects. This aligns with Dubai’s broader vision of becoming one of the world’s smartest and most sustainable cities.

Properties in eco-friendly communities or those with smart home automation systems are in high demand. Buyers are willing to invest more in properties that offer long-term utility savings and align with global environmental standards. This trend is expected to shape the future trajectory of the emirate’s real estate offerings.

Rental Yields and Capital Appreciation Appeal to Investors

Dubai continues to offer attractive rental yields compared to many global cities. Areas such as Jumeirah Village Circle, Dubai Silicon Oasis, and International City deliver yields that range between 6% to 9%, making them popular choices for buy-to-let investors. The consistent population growth and influx of expatriates contribute to a healthy rental market.

At the same time, capital appreciation remains a key motivator, especially in areas undergoing infrastructure upgrades or new development launches. Investors are keen on leveraging market cycles to maximize returns, and Dubai’s transparency in transaction data supports informed decision-making.

Market Outlook and Future Projections

Analysts and real estate professionals are optimistic about Dubai’s property market trajectory for the remainder of the year. The strong weekly transaction figures suggest that demand will continue to outpace supply in several segments, leading to potential price appreciation. Developers are expected to respond with new launches, further enriching the property landscape.

Expo City Dubai, upcoming mega projects, and the anticipated population increase by 2040 are long-term factors that will influence property demand. The continued diversification of the UAE economy and enhancements in lifestyle infrastructure further cement Dubai’s position as a global real estate powerhouse.