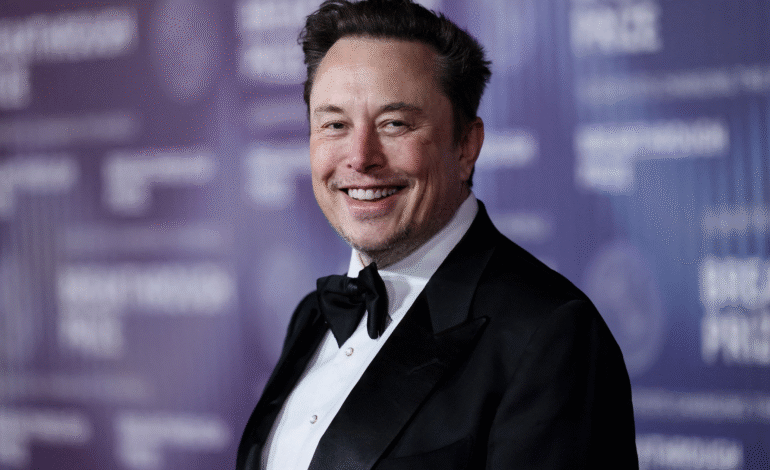

Tesla CEO Elon Musk has once again grabbed headlines. This time, not with a tweet or a new product, but with his wallet. On September 12, 2025, Musk purchased almost $1 billion worth of Tesla stock. This is his first big open-market buy in more than five years, and it has set the financial world buzzing.

According to filings with the U.S. Securities and Exchange Commission (SEC), Musk bought about 2.57 million shares. He spread the purchase across 25 separate transactions. Prices ranged between $372 and $396 per share, with an average of $389 per share.

The move came through the Elon Musk Revocable Trust, where Musk is the trustee. After news broke on September 15, 2025, Tesla shares jumped by over 6%, trading at $422.25 by mid-morning.

For investors, this was more than just a transaction. It was a clear message: Musk believes Tesla’s future is brighter than what today’s price shows.

The Biggest Insider Buy in Tesla’s History

This purchase is not just large. It is the biggest insider buy by value in Tesla’s history. Musk has sold Tesla stock many times in the past, especially when raising cash to fund his 2022 Twitter (now X) acquisition. But for years, he avoided buying.

That’s why this move stands out. It is a sharp reversal of his past selling activity. For shareholders, it suggests that Musk sees Tesla’s stock as undervalued. For critics, it raises new debates about timing, motives, and strategy.

The $1 Trillion Pay Package in the Spotlight

Adding to the drama, Tesla’s board recently proposed a new pay package for Musk. This is not an ordinary compensation plan. If approved, it could be worth up to $975 billion (almost $1 trillion).

To earn this package, Musk must deliver on ambitious goals over the next decade. These include:

- Growing Tesla’s market value to $8.5 trillion (from about $1.3 trillion today).

- Deploying one million autonomous robotaxis.

- Building one million humanoid robots.

- Increasing profits more than 20 times.

A shareholder vote on this plan is set for November 2025. Musk’s $1 billion stock buy looks like a way to show faith in the company while strengthening his hand ahead of the vote.

Tesla Stock Surges After Musk’s Move

The market reaction was swift. On September 15, 2025, Tesla shares surged by 6–9% in early trading. This erased the company’s small year-to-date losses and pushed the stock into positive territory for the year.

The surge also boosted Musk’s own net worth, already above $419 billion. In fact, the early gains on his new shares nearly covered the entire cost of the purchase.

Investors piled in, with trading volume hitting record highs. The message was clear: when Musk buys, the market listens.

What Analysts Are Saying

Analyst opinions are divided, but many lean positive. Out of 64 analysts surveyed, about 50% recommend buying or strong buying. They highlight Tesla’s progress in clean energy, AI, and new model launches.

Still, some caution remains. Tesla faces serious challenges:

- Weakening global EV demand, especially as competition from Chinese automakers grows.

- US tax credits for EVs expiring at the end of September, making sales harder.

- Political controversies linked to Musk, which have hurt Tesla’s image in some markets.

- Legal setbacks, such as a $243 million verdict related to Autopilot and ongoing EU probes into self-driving claims.

These risks mean Tesla’s future is far from guaranteed, even with Musk’s show of confidence.

Why This Matters for the UAE and Middle East

For investors and business leaders in the UAE and Middle East, this story offers important lessons.

-

Bold Bets on AI and Robotics

Tesla is no longer just an electric car maker. Musk’s vision now includes robotaxis, humanoid robots, and advanced AI systems. These align with the Middle East’s own ambitions in AI, smart mobility, and robotics. Countries like the UAE and Saudi Arabia are already investing heavily in these areas. Musk’s moves confirm that this is where the future value lies.

-

Insider Buying as a Signal

When a CEO buys shares in his own company, it often signals confidence. Musk’s $1 billion purchase is a textbook example. For regional investors, this highlights the importance of watching insider activity. It can provide strong clues about where leaders believe the company is headed.

-

Vision That Inspires

Musk’s targets may sound extreme: one million robotaxis and humanoid robots. But bold visions attract investment and talent. In the UAE, projects like Dubai’s Smart City drive or Saudi Arabia’s NEOM project show similar ambition. The lesson is clear: big dreams create attention and capital, even if they seem risky.

-

Balancing Risk and Reward

The pay package could make Musk the first trillion-dollar CEO. But only if Tesla meets its huge goals. If it fails, the risks are equally large. For Middle East investors, this underlines the need to balance bold bets with careful planning, especially in high-growth sectors like clean tech, EVs, and AI.

What Comes Next

The coming months will be crucial for Tesla. Key events to watch include:

- The November 2025 shareholder vote on Musk’s pay package.

- Progress on robotaxi trials and robot development.

- EV sales numbers, especially after US tax credits end.

- Regulatory investigations in both the US and EU.

- Broader market conditions, including possible Federal Reserve rate cuts.

Each of these could push Tesla’s stock higher or lower

Lessons for Investors in the Region

For our readers in the UAE and Middle East, here’s what this means in practical terms:

- Global stock exposure: If you invest in funds or ETFs that include Tesla, Musk’s buy could be a signal to hold or even increase exposure.

- Regional opportunities: Look for local companies in AI, robotics, and smart mobility. These sectors are in line with global trends.

- Risk management: Remember that big rewards often come with big risks. Diversification remains key.

- Policy planning: Governments and regulators in the Middle East can study Tesla’s model when shaping future policies on AI, EVs, and robotics.

The Bigger Picture

This story is about more than one billionaire buying stock. It is about how confidence, vision, and leadership shape markets. Musk’s move reminds investors why Tesla is not just another car company. It is a company betting its future on technology, AI, and bold innovation.

For the Middle East, where governments and companies are already investing in futuristic industries, this offers both inspiration and caution. The road to building the future is exciting, but it is never smooth.