UAE Free Zones in 2025: Your Guide to Business Success

The United Arab Emirates (UAE) has solidified its position as a global business hub, attracting entrepreneurs, startups, and multinational corporations with its strategic location, business-friendly policies, and world-class infrastructure. At the heart of this success are the UAE’s free zones, specialized economic areas designed to foster foreign investment, innovation, and economic diversification. In 2025, with over 40 free zones across Dubai, Abu Dhabi, Sharjah, and other emirates, these zones offer unparalleled benefits like 100% foreign ownership, tax exemptions, and streamlined business setup. This guide explores everything you need to know about UAE free zones, their advantages, and how to choose the right one for your business in 2025.

What Are UAE Free Zones?

Free zones in the UAE are designated areas with special tax, customs, and import regulations, operating under their own frameworks, except for UAE criminal law. Governed by independent Free Zone Authorities (FZAs), these zones provide businesses with a hassle-free environment to thrive. Located across Dubai, Abu Dhabi, Sharjah, Fujairah, Ajman, Ras Al Khaimah, and Umm Al Quwain, free zones cater to specific industries such as technology, finance, logistics, media, healthcare, and ecommerce. Their strategic locations near ports, airports, or urban centers enhance accessibility and global connectivity.

Key Benefits of UAE Free Zones in 2025

UAE free zones offer a range of advantages that make them attractive for entrepreneurs, SMEs, and global corporations:

- 100% Foreign Ownership: Unlike mainland businesses, free zones allow full ownership without the need for a local sponsor, giving investors complete control.

- Tax Exemptions: Businesses enjoy 0% corporate tax on qualifying income, no personal income tax, and exemptions from customs duties, fostering higher profitability.

- Simplified Setup: Free zones provide streamlined registration processes, cost-effective licensing, and visa flexibility for employees and dependents.

- World-Class Infrastructure: Access to modern office spaces, warehouses, and logistics facilities supports seamless operations.

- Industry-Specific Support: Each free zone is tailored to specific sectors, offering specialized services like networking, training, and industry-focused infrastructure.

Top Free Zones in the UAE for 2025

The UAE’s free zones are spread across its seven emirates, each offering unique benefits tailored to business needs. Here are some of the most prominent free zones in 2025, with their locations and key features:

Dubai Free Zones

- Dubai Multi Commodities Centre (DMCC)

Location: Almas Tower, Jumeirah Lakes Towers, Dubai

- global leader in commodities trade, DMCC supports businesses in gold, diamonds, energy, and financial services. It offers flexible office solutions, a vibrant community, and networking opportunities, making it ideal for international trade.

- Jebel Ali Free Zone (JAFZA)

Location: Near Jebel Ali Port, Dubai

One of the largest free zones in the Middle East, JAFZA is perfect for logistics, manufacturing, and trading, with seamless connectivity via Jebel Ali Port and Al Maktoum International Airport.

- Dubai International Financial Centre (DIFC)

Location: Sheikh Zayed Road, Dubai

- globally recognized financial hub, DIFC supports banking, insurance, fintech, and investment firms with a robust legal framework and proximity to Dubai’s business district.

Abu Dhabi Free Zones

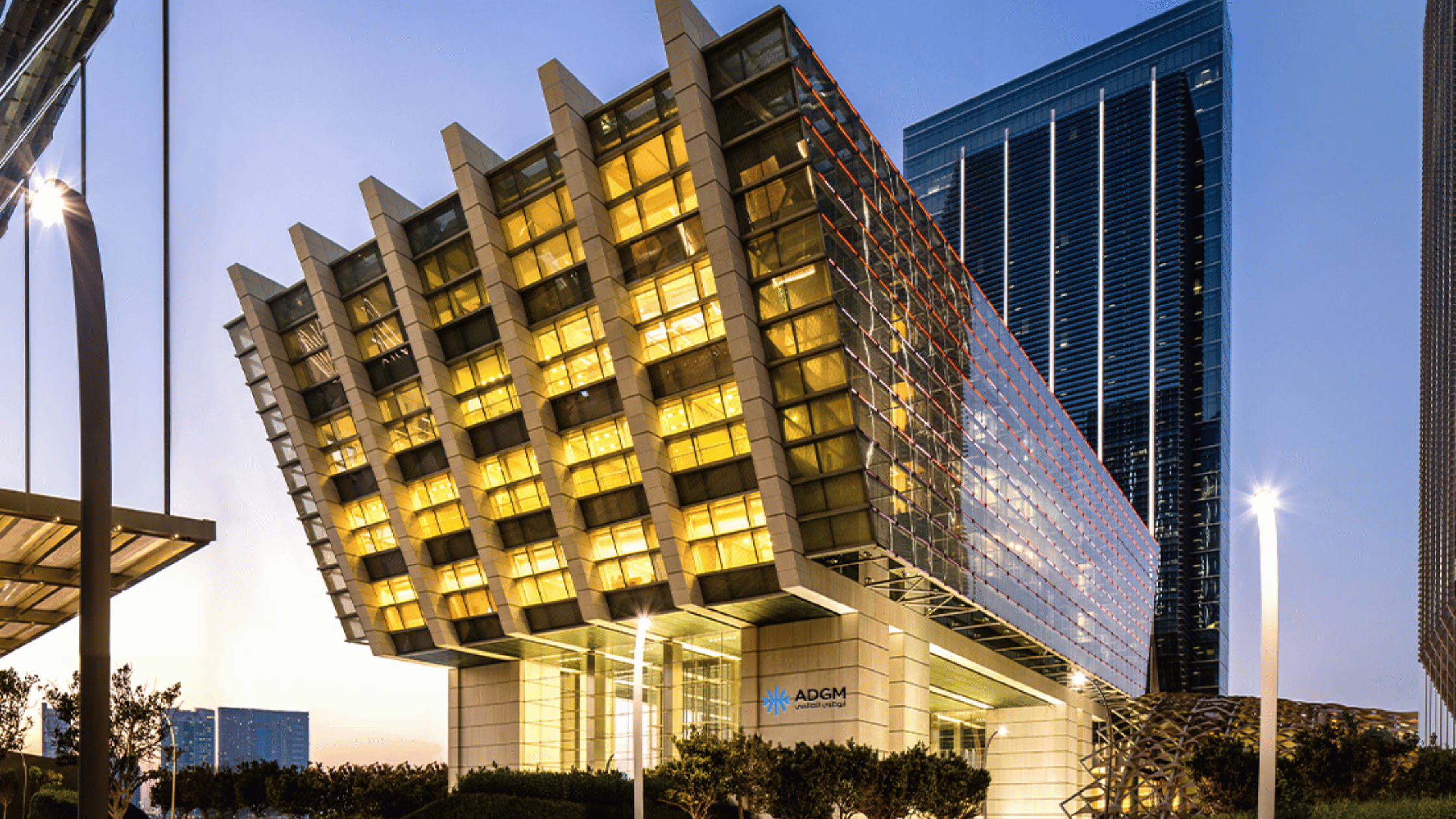

- Abu Dhabi Global Market (ADGM)

Location: Al Maryah Island, Abu Dhabi

A leading financial free zone, ADGM is ideal for fintech, wealth management, and professional services, offering a business-friendly regulatory environment.

- Khalifa Industrial Zone Abu Dhabi (KIZAD)

Location: Near Khalifa Port, Abu Dhabi

Focused on manufacturing, logistics, and trade, KIZAD provides cost-effective solutions and access to global markets.

Sharjah Free Zones

- Sharjah Research Technology and Innovation Park (SRTIP)

Location: University City Road, Sharjah

A hub for technology, research, and innovation, SRTIP supports startups and tech firms with state-of-the-art facilities.

- Hamriyah Free Zone (HFZ)

Location: Near Hamriyah Port, Sharjah

Ideal for manufacturing, trading, and shipping, HFZ offers affordable setup costs and access to regional markets.

Ras Al Khaimah Free Zone

- Ras Al Khaimah Economic Zone (RAKEZ)

Location: Ras Al Khaimah

Known for cost-effective setups, RAKEZ caters to startups, freelancers, and industrial businesses in manufacturing, trading, and services.

Other Emirates

- Ajman Free Zone (AFZ)

Location: Near Ajman Port, Ajman

- cost-effective option for e-commerce, trading, and service-based businesses, AFZ offers flexible licensing and visa options.

- Fujairah Free Zone (FFZ)

Location: Near Fujairah Port, Fujairah

Focused on trading, shipping, and logistics, FFZ benefits from its proximity to key maritime routes.

- Umm Al Quwain Free Trade Zone (UAQ FTZ)

Location: Umm Al Quwain

- growing hub for SMEs and freelancers, UAQ FTZ offers affordable setups for consulting, trading, and e-commerce. Choosing the Right Free Zone

Selecting the ideal free zone depends on several factors:

- Business Activity: Align your business with a free zone’s industry focus, such as DMCC for commodities or SRTIP for technology.

- Budget: Setup costs vary, with zones like RAKEZ and AFZ offering affordable options for startups.

- Location: Proximity to ports, airports, or urban centers can impact logistics and accessibility. For example, JAFZA is ideal for import-export businesses due to its port access.

- Legal Requirements: Each free zone has specific rules on capital requirements, office space, and permitted activities. Consult the Free Zone Authority for clarity.

Designated Zones and VAT Benefits

Certain free zones are classified as Designated Zones under UAE’s VAT system, offering exemptions on specific goods and services. For instance, supplies within zones like JAFZA or DMCC may be VAT-exempt under specific conditions, enhancing cost savings. Always verify eligibility with the UAE Federal Tax Authority. Why Invest in UAE Free Zones in 2025?

The UAE’s free zones are pivotal to its economic diversification strategy, reducing reliance on oil and fostering innovation, trade, and investment. In 2025, these zones continue to attract businesses with:

- Strategic Location: Positioned between Europe, Asia, and Africa, the UAE offers unmatched access to global markets.

- Economic Stability: The UAE’s robust economy and investor-friendly policies ensure long-term growth.

- Support Services: Free zones provide labor recruitment, visa processing, and business support, simplifying operations. How to Set Up in a UAE Free Zone

- Choose a Free Zone: Research zones based on your industry and budget.

- Select a Business Type: Options include Free Zone Establishment (FZE), Free Zone Company (FZC), or branch office.

- Submit Documents: Provide passports, business plans, and other requirements to the Free Zone Authority.

- Obtain Licenses: Choose from trading, industrial, service, or e-commerce licenses.

- Open a Bank Account: Benefit from corporate bank account options tailored for free zone businesses.

1 Comment

[…] The United Arab Emirates (UAE), with its thriving hubs in Dubai, Abu Dhabi, and Sharjah, is a hotspot for professionals seeking remote work opportunities. As the global workforce shifts toward flexibility, the demand for remote jobs in the UAE has surged, driven by the country’s robust economy and diverse industries like technology, finance, and hospitality. In 2025, job seekers can leverage specialized job portals to find work-from-home and flexible roles across the UAE. […]

Comments are closed.